Annual Reports

- 2022

- 2021

- 2020-2019

Milestones

Number of IPOs and SPACs in which we participated

Average return on IPO deals, per annum

Real Estate investments

Average growth on Real Estate assets since purchase (as of 31.12.2020)

Assets under management by B1MARS Capital

Number of IPOs and SPACs in which we participated

Exploring the worlds of Real Estate and IPOs

B1MARS began is venture in 2019 with Real Estate investments in Kiev, Ukraine and expanded into Public Equity investments, specifically in US initial public offerings (IPOs), in 2020.

Public Equity

In Public Equity, we make long-term investments in Initial Public Offerings (IPOs), Special Purpose Acquisition Companies (SPACs), and the secondary market.

Real Estate

In Real Estate, we focus on investment opportunities in Kiev, Ukraine, with a particular emphasis on investing in residential projects during the construction phase.

Portfolio properties

Average portfolio growth since purchase

Residential complex – Taryan Towers

Taryan Towers: A New Landmark in Kiev.

Taryan Towers will stand out with its innovative architecture and state-of-the-art infrastructure. Three interconnected towers, connected by both a common four-story base and glass two-story bridges, feature a pedestrian zone with walking and running tracks, while some sections of the bridge floor are made of glass to offer stunning views. Each tower has its own unique concept, including a panoramic restaurant, an open-air park with an artificial lake and winter garden, and a cinema, planetarium and future museum.

B1MARS Capital invested in the project during its early stages and aims to exit after the completion of all infrastructure.

Participate in more ICOs and SPACs.

Search for more Real Estate opportunities in Kiev, Ukraine with potential ROI 100%.

Develop relationships with the funds that have Private Equity deals in the US market. Start investing.

Milestones

Number of IPOs and SPACs in which we participated

Average return on IPO deals, per annum

Crypto projects funded

Private equity investments

New Real Estate investments

Average growth on our four (4) Real Estate assets since purchase (as of 31.12.2021)

New Partnerships with funds and VCs

Assets under management by B1MARS Capital

Expanding investment sectors and partnerships.

The goal of B1MARS is to invest and grow its portfolio across four (4) distinct sectors. In 2021, the company made strides in furthering this mission by expanding into private equity and cryptocurrency investments. These additions diversify the long-term portfolio, providing a stake in cutting-edge companies and projects, as well as potential profits within 1-3 years.

B1MARS has also formed new partnerships with funds and venture capital firms in the US, Europe, UAE, and Ukraine, granting greater flexibility and opportunities for profitable deals.

B1Mars is divided into four (4) investment divisions: Public Equity, Private Equity, Crypto and Real Estate.

We select investments based on business fundamentals with a focus on unit economics and potential revenue.

In the Public Equity we take our long positions of the IPOs, SPACs and secondary market. At the Private Equity division we co-invest into the growth and pre-IPO stages of private companies. Backing bold entrepreneurs who are building crypto companies and protocols. And, finally, our Real Estate divisions – this is very we started our journey in 2019. We hold the assets for the resale and building our apart-hotel in the center of Kiev, Ukraine.

Together, the four lines of business work synergistically to diversify our portfolio and risks, and increase our access to interesting projects and high profits.

Private Equity

It’s our growth and pre-IPO stages co-investments focused on profitability and resiliency.

In 2021, we had chance to co-invest into the following companies: Convoy, Udacity, Automation Anywhere, Carbon 3D, The First Digital Bank, Kraken, OYO Rooms, Cybereason.

New Portfolio companies

Crypto

We are short and long-term, patient investors. We have a committed capital base and expect to hold investments from 2 months to 2 years.

In 2021, we had chance to co-invest into the following projects: Next Level, KOII, Red DAO, 11Minutes, HAX Wars P2E, Sophos Metaverse Holdings (SMH), Cherry Network, Upside.

New Portfolio companies

Real Estate

We expanded our portfolio in Kiev, Ukraine by adding a commercial property and a penthouse for an apart-hotel that will be opened in autumn 2022.

Portfolio properties

New properties in 2021

Average portfolio growth since purchase

Residential hotel in the heart of Kiev.

The Residential Hotel, a luxurious penthouse, is situated in the bustling center of Kiev, Ukraine, featuring 3.5 floors of accommodation, including two duplex apartments on the 3rd floor. With a total area of 450 square meters, the residential hotel will offer 10 spacious rooms averaging 30 square meters each, along with three terraces, including a breathtaking 180-degree panoramic view of the city from the top floor. Our aim is to offer guests, both foreign tourists and local travelers, a memorable and enjoyable experience during their stay in the capital of Ukraine.

Global Summary

2022 was a challenging year for investors as the global economy faced multiple headwinds such as the ongoing impact of the COVID-19 pandemic, rising interest rates, and increasing inflation concerns. These factors resulted in a volatile stock market, with significant fluctuations in the value of investments.

The uncertainty also led to a decrease in consumer confidence and spending, further impacting the overall economy and investor’s portfolios. Despite these difficulties, many investors remained focused on long-term strategies and sought to weather the storm through diversification and a disciplined approach to investment.

The Russia-Ukraine conflict escalated in 2022 and led to war. It caused concern among global investors and created instability in the region. The situation had a negative impact on the markets and added to the already challenging investment environment, as investors are often cautious about investing in regions affected by political or military

turmoil.

This year was indeed a difficult one for the company and the global financial markets, but despite the challenges, B1MARS remained active across its various investment sectors, including real estate, public and private equity, and cryptocurrency. The company’s focus on holding onto its assets and maintaining its investment strategy, despite the challenges, demonstrated its commitment to weathering the storm and navigating the uncertainties of the financial markets.

By staying the course, B1MARS aimed to capitalize on the eventual market recovery and achieve its long-term investment objectives. The company remained confident in its approach and continued to focus on its goals, keeping an eye on market conditions and making adjustments as needed to best position itself for success in the future.

A quick summary by the sectors:

Real Estate

As part of its real estate investment portfolio, B1MARS held four (4) properties in Kiev, Ukraine. The properties are well-maintained and safe.

4

Portfolio properties

Despite the challenges posed by the war, the company remained confident in the long-term potential of its properties and continued to hold onto them. The properties are waiting for better market conditions to realize their full value, and B1MARS remained vigilant in monitoring the situation. By taking a prudent and measured approach during the investment initiative, the company is well-positioned to achieve its investment goals by the end of the war and maximize the value of its portfolio.

Despite the ongoing war that started on February 24th, 2022 and uncertainty, the renovation works of the Residential Hotel continued from June 2022. The hotel industry, like many others, had been impacted by the war. Many people in Ukraine were forced to close their

businesses, some of them left the country. B1MARS Team instead had the determination to complete the project, showed resilience in the face of adversity and demonstrated the strong resolve of those involved. The works progressed smoothly, and we finished the first stage of renovations before the winter.

We expect to continue the work in spring 2023. The Residential Hotel is expected to open its door and welcome guests until the end of 2023. Despite the challenges posed by the conflict, the team is committed to deliver a first-class experience for its guests.

The progress is shown in the pictures:

Public Equity

The stock market saw significant instability in 2022, as the S&P index plummeted between 4800 and 3500, and the Nasdaq dropped from 15,900 to 10,100. The market was highly unpredictable and volatile.

By December 31st, 2022, B1MARS had experienced an approximate 25% decrease in its portfolio compared to the portfolio value on December 31st, 2021.

We don’t view the decrease in portfolio as a loss. In light of the anticipated uncertainty in 2022, a decision was made at the end of 2021 to reduce the portfolio and maintain a level that would not surpass the earnings from 2020 and 2021. Over a three-year period, including 2020, 2021, and 2022, B1MARS generated a favorable ROI of approximately 30% per annum.

This report is being written in February 2022, and we have observed a significant improvement in the portfolio in January by 9%. The current overall loss is approximately 16%. We anticipate a full recovery of the portfolio and hope to see growth by the end of 2023.

It’s noteworthy that we have begun diversifying our portfolio and adopting a more cautious approach. With the assistance of our consulting firm, Bienrock Consulting in Geneva, Switzerland, we have opened bank accounts with a top-notch Swiss investment bank and established a conservative portfolio consisting of bonds and structured products with an ROI target of 5-10% per annum.

For further details about Bienrock, please visit our website at

https://bienrock.ch/

Private Equity and Crypto

The investments made by the company were diversified across both private equity and cryptocurrency, with a total of eight portfolio companies in each sector.

This approach helped to mitigate the risks associated with any single investment and ensured a balanced portfolio. The investments were also designed with a long-term strategy in mind, with most of the portfolio companies having planned exits during the 2024-2026 time frame. This allowed the company to take advantage of market conditions and capitalize on the growth potential of its portfolio companies. The company remained committed to its investment philosophy, combining careful analysis and due diligence with a long-term perspective to ensure the success of its portfolio.

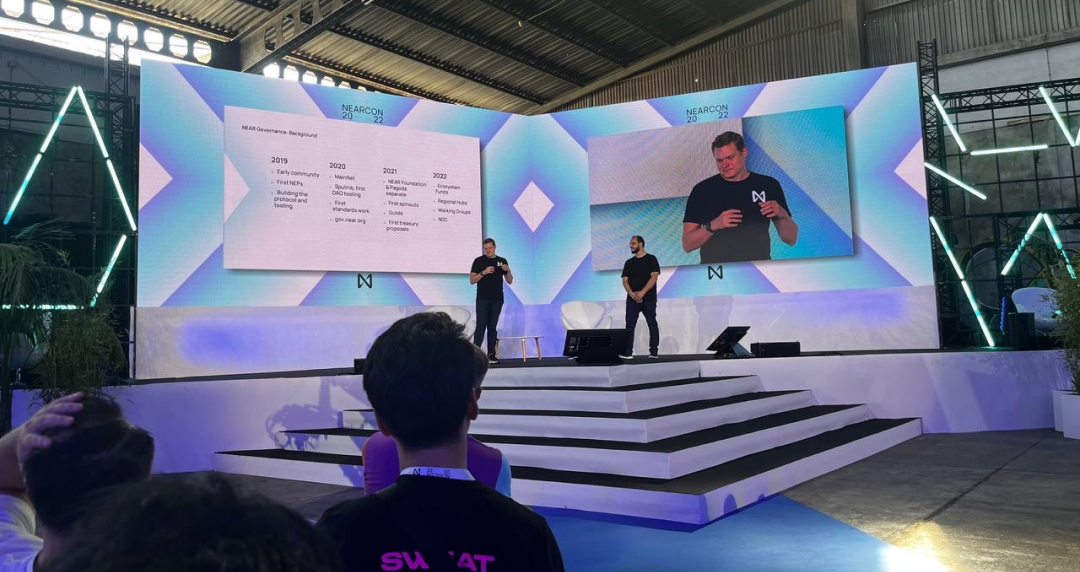

Conferences

In September 2022, B1MARS Team and their partners from BABs Labs https://babslabs.io/ attended the Nearcon conference in Lisbon, Portugal. The conference was a great opportunity for the B1MARS team to network and collaborate with other experts in the field, and they returned home with valuable new contacts and ideas.

Complete the renovation of the Residential Hotel in Kiev, Ukraine and receive our first guests by the end of the year.

Explore other emerging markets, like Georgia, for potential real estate projects.

Attain full recovery and growth of the public equity portfolio by the end of 2023.

Implement a more prudent strategy that is sustainable during 2023-2025. Diversify the public equity portfolio and increase investment in bonds and structured products with a targeted ROI of 5-10% per annum.

Attend more technology conferences, broaden our network, and persistently search for partnerships that can yield significant outcomes.

Create a startup utilizing ChatGPT technology. If successful, follow us on our social media for updates and potential investment opportunities :)

Telegram channel with investment deals

We publish all Private Equity and Crypto opportunities that we have in our hands here. Join if interested.

This page is intended for information purposes only. It does not constitute legal or investment advice. This information should not be considered as an offer or recommendation for investment, purchase, sale of any asset, trading of financial instruments, an offering of securities or as investment advice or any recommendation as to an investment or other strategy by our Company.

Investments can result in total loss, and may be impossible to resell. Read about risks. Private investments are risky and illiquid, never invest more than you can afford to lose, consult with your trusted advisors and do your own diligence before investing.